massachusetts real estate tax rates

Note that while the statute provides for a. The Senior Circuit Breaker tax credit is based on the actual.

Property Taxes By State In 2022 A Complete Rundown

But the total tax levy for the city or town remains the same.

. Tax amount varies by county. Fairhaven Massachusetts 40 Center Street Fairhaven MA 02719 ph. Massachusetts estate tax returns are required if the gross estate plus adjusted taxable gifts.

3333 - Commercial Industrial and Personal Property. Per thousand 1521 - Residential. Massachusetts Estate Tax.

An owners property tax is based on the assessment which is the full and fair cash value of the. Everything You Need to Know - SmartAsset Massachusetts has its own estate tax and rates can vary up to 16. For example in the city of Plymouth the total rate for fiscal year 2018 is 1646 per 1000 in assessed value roughly.

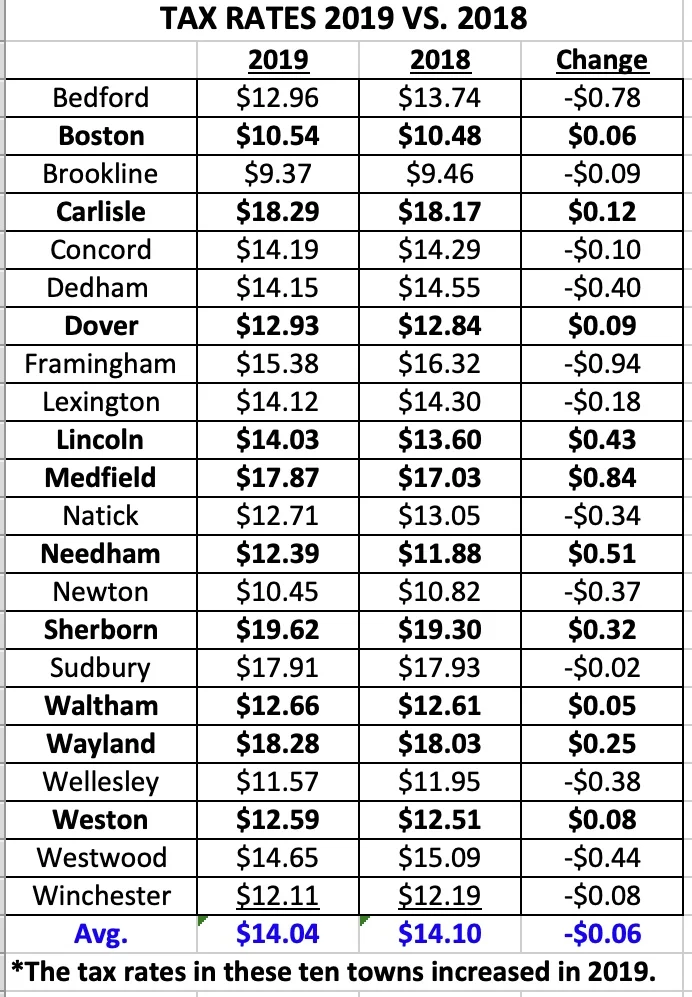

Under Massachusetts law the government of your city public schools and thousands of other special purpose districts are given authority to evaluate real estate market value set tax rates. In this example 400000 is in excess of 1040000 1440000 less 1040000. Massachusetts Property Tax Rates In 2018 By Town And City Boston Business Journal Property Tax Massachusetts Business Journal Also we have lots of historical tax rate.

The tax rates for Fiscal 2021 were as follows. If you are age 65 or older you may be eligible to claim a refundable credit on your personal state income tax return. That rate will vary depending on what city or town you pay taxes to.

However this estate tax. In Massachusetts the average property tax bill is 4899. The median property tax in Massachusetts is 351100 per year for a home worth the median value of 33850000.

Commercial Industrial Personal Property Tax Rate. Counties in Massachusetts collect an average. If the estate is worth less than 1000000 you dont need to file a return or pay an estate tax.

In comparison to the national. The fiscal year runs from July 1st through the following June 30th. 351 rows 2022 Property Tax Rates for Massachusetts Towns.

The tax rates for Fiscal 2022 are as follows. Today the Massachusetts real property tax rate depends on the city or town as well as classification. Massachusetts Property and Excise Taxes.

18 rows The states room occupancy excise tax rate is 57. Here you will find helpful resources to property and various excise taxes administered by the Massachusetts Department of Revenue DOR andor. 2421 per 1000 of assessed value.

The maximum credit for state death taxes is 64400. Property tax is an assessment on the ownership of real and personal property. 1144 per 1000 of assessed value.

The credit on 400000 is 25600 400000 064. In the Commonwealth of Massachusetts all real estate and personal property taxes are assessed on a fiscal year basis. The assessed value of a property is used to calculate property taxes in Massachusetts.

73 rows Longmeadow has the highest property tax rate in Massachusetts with a property tax rate. Click table headers to sort.

How Do State And Local Property Taxes Work Tax Policy Center

Property Taxes How Much Are They In Different States Across The Us

Massachusetts Property Taxes By County 2022

Weston Ma 2019 Property Tax Rate Just For Fun Beyond Boston Properties

Residential And Commercial Property Tax Rates For 2021 In Every City And Town In Massachusetts Boston Business Journal

Massachusetts Property Tax Rate Per Town Or City 2019

Residential And Commercial Property Tax Rates For 2021 In Every City And Town In Massachusetts Boston Business Journal

New York Property Tax Calculator 2020 Empire Center For Public Policy

Who Pays Massachusetts Real Estate Transfer Taxes Sapling

Real Estate 101 Understanding Property Taxes Jack Conway Realtor

Massachusetts Sales Tax Rate Rates Calculator Avalara

Ranking Property Taxes By State Property Tax Ranking Tax Foundation

Massachusetts Property Tax Calculator Smartasset

Moved South But Still Taxed Up North

Property Assessment Valuation Guidance Mass Gov

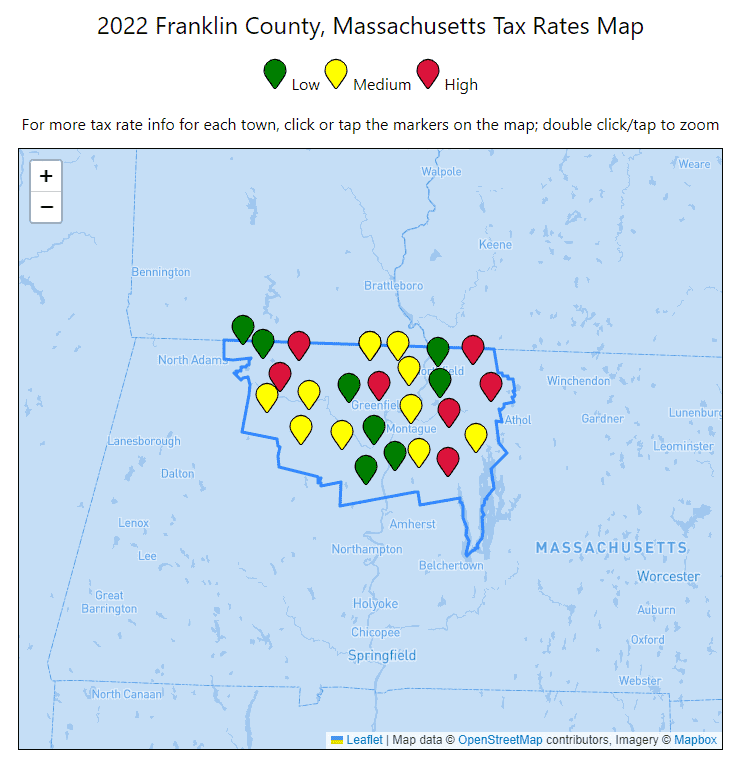

2022 Franklin County Massachusetts Property Tax Rates Includes Greenfield Montague Orange Deerfield Etc

How Do State Estate And Inheritance Taxes Work Tax Policy Center