utah non food tax rate

Average Sales Tax With Local. 2022 Utah state sales tax.

Eliminating Grocery Sales Tax In Utah Likely Wouldn T Help Low Income Families Expert Says Ksl Com

Kristin Murphy Deseret News.

. Only one rate will apply to a single transaction. January 1 2008 December 31 2017. Twenty-three states and DC.

In the state of Utah the foods are subject to local taxes. What is the 2021 Utah Sales Tax Rate. For example the rate of 1282 applies to the total taxable transient room charges in West Haven City.

Sales of grocery food unprepared food and food ingredients are subject to a lower 3 percent rate throughout Utah. The example above illustrates what kind of an impact allowing a family to spend the money differently would make. Utah has a 485 statewide sales tax rate but also has 131 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 211 on top of the state tax.

The rates under Transient Room Prepared Food and Short Term Leasing include the applicable Combined Sales and Use tax rate. With local taxes the total sales tax rate is between 6100 and 9050. But a bagel sold with utensils is considered.

91 rows This page lists the various sales use tax rates effective throughout Utah. This means that depending on your location within Utah the total tax you pay can be significantly higher than the 485 state sales tax. Counties and cities can charge an additional local sales tax of up to 24 for a maximum possible combined sales tax of 835.

Both food and food ingredients will be taxed at a reduced rate of 175. The state sales tax rate in Utah is 4850. Utah specifies that prepared food is considered ready to eat or sold with utensils.

Department of Agriculture low-income families spend 36 of their income on food compared to 8 for high-income families. Treat either candy or soda differently than groceries. Restaurants that sell grocery food in addition to prepared food may collect the lower 3 percent tax on their grocery food sales but ONLY IF those items are listed separately on the receipt or invoice.

If you have grocery food sales report total tax for grocery food. Exact tax amount may vary for different items. Tax calculation grocery food sales.

According to the US. See Utah Code 59-12-602 5 and 59-12-603 1 a. TAP will total tax due for you.

It disproportionately hurts low-income Utahns and contributes to food insecurity. In resort communities the Resort Exempt rate is the Combined Sales and Use. Based off of Utahs current sales tax rate on unprepared food of 175 Berni probably pays around 1925 a month in sales tax on food.

Instead of exempting food and food ingredients from Utah sales and use tax as originally planned the law taxes them at a reduced rate of 275. The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668. The state provides a guidance page with plenty of examples on what is and what is not considered prepared food in Utah.

Counties and cities can charge an additional local sales tax of up to 24 for a maximum possible combined sales tax of 835. There are only 13 states which tax food at any rate while 37 states have no sales tax on food at all. Grocery food does not include alcoholic beverages tobacco or prepared food.

Please email us your phone number and question if we do not answer the phone. The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668. Its a proposal that has not found traction within the Republican-controlled Utah Legislature and its leadership which this year prefers an.

Sales Tax Treatment of Groceries Candy Soda as of July January 1 2019 a Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on groceries candy or soda. However in a bundled transaction which involves both food food ingredients and any other taxable items of tangible personal property the rate will be 465. 2021 Utah state sales tax.

For example a bagel sold without utensils is considered a grocery item and taxed at the reduced 3 rate. But Utahs existing tax on food even at its lower rate of 175 compared to the full 485 sales tax rate is still wrong. Utah has recent rate changes Thu Jul 01 2021.

About a dozen Democratic Utah lawmakers and poverty advocates and one Republican huddled in the cold outside of the Utah Capitol on Tuesday to call for a repeal of the states food tax. Utah has state sales. Rates include state county and city taxes.

PLEASE CALL OR EMAIL David Swan dswandswanutahgov 385-377-2309 Jennifer Hansen jjhansenutahgov 801-297. These rate charts should not be used for sourcing sales from out-of-state sellers to locations in Utah. The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668.

Utah lawmaker Rosemary Lesser is leading the cause to eliminate sales tax from food purchases. Back to Utah Sales Tax Handbook Top. January 1 2022 current.

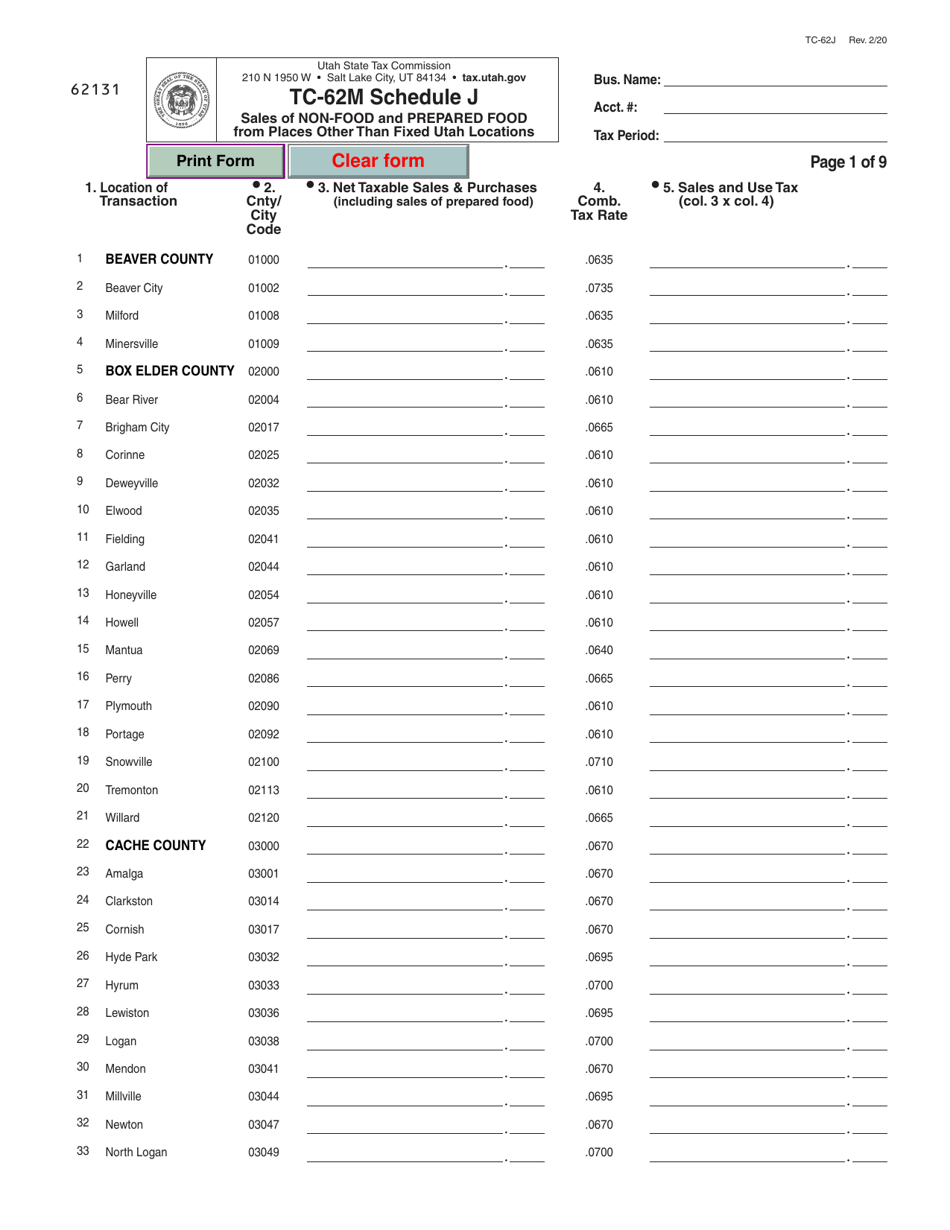

Non-food and prepared food sales. Thats about 409 in state sales taxes more a year equalling about 640 a. We will get back to you ASAP.

Popular Counties All A B C D E F G H I J K L M N O P R S T U V W. 274 rows Utah Sales Tax. Enter the amount of sales here.

Exact tax amount may vary for different items. Eleven of the states that exempt groceries from their sales tax base include both candy and soda in their definition of groceries. The state sales tax rate in Utah is 4850.

January 1 2018 December 31 2021. The state of Utah currently taxes food at a rate of 175. Like lotteries state taxes on food amount to a tax on the poor.

Utah UT Sales Tax Rates by City. Lesser Food Sales Tax Amendments HB165 and the second is sponsored by Rep. With the rate restored to the full 485 Berni will likely spend around 5335 in state sales tax a month or about 3410 more.

Arizona Georgia Louisiana Massachusetts Michigan Nebraska Nevada New Mexico South Carolina Vermont and Wyoming. Select the Utah city from the list of popular cities below to see its current sales tax rate. Matt Hurst matthewhurstutahgov 385-377-9408 Jared Rezendes jrezendesutahgov 385-499-0553 NEED HELP LOGGING IN.

Utah Income Tax Calculator Smartasset

Utah Sales Tax Small Business Guide Truic

States Without Sales Tax Article

States With Highest And Lowest Sales Tax Rates

Utah Sales Tax Rates By City County 2022

Form Tc 62m Schedule J Download Fillable Pdf Or Fill Online Sales Of Non Food And Prepared Food From Places Other Than Fixed Utah Locations Utah Templateroller

State And Local Sales Taxes In 2012 Tax Foundation

Utah Lawmakers And Community Members Want To End The Sales Tax On Food Items Kuer

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Utah Tax Rates Rankings Utah State Taxes Tax Foundation

Gov Cox Wants To Give Utahns 160m In A Grocery Tax Credit

Is Food Taxable In Utah Taxjar

Sales Tax On Grocery Items Taxjar

State Motor Fuel Tax Rates The American Road Transportation Builders Association Artba